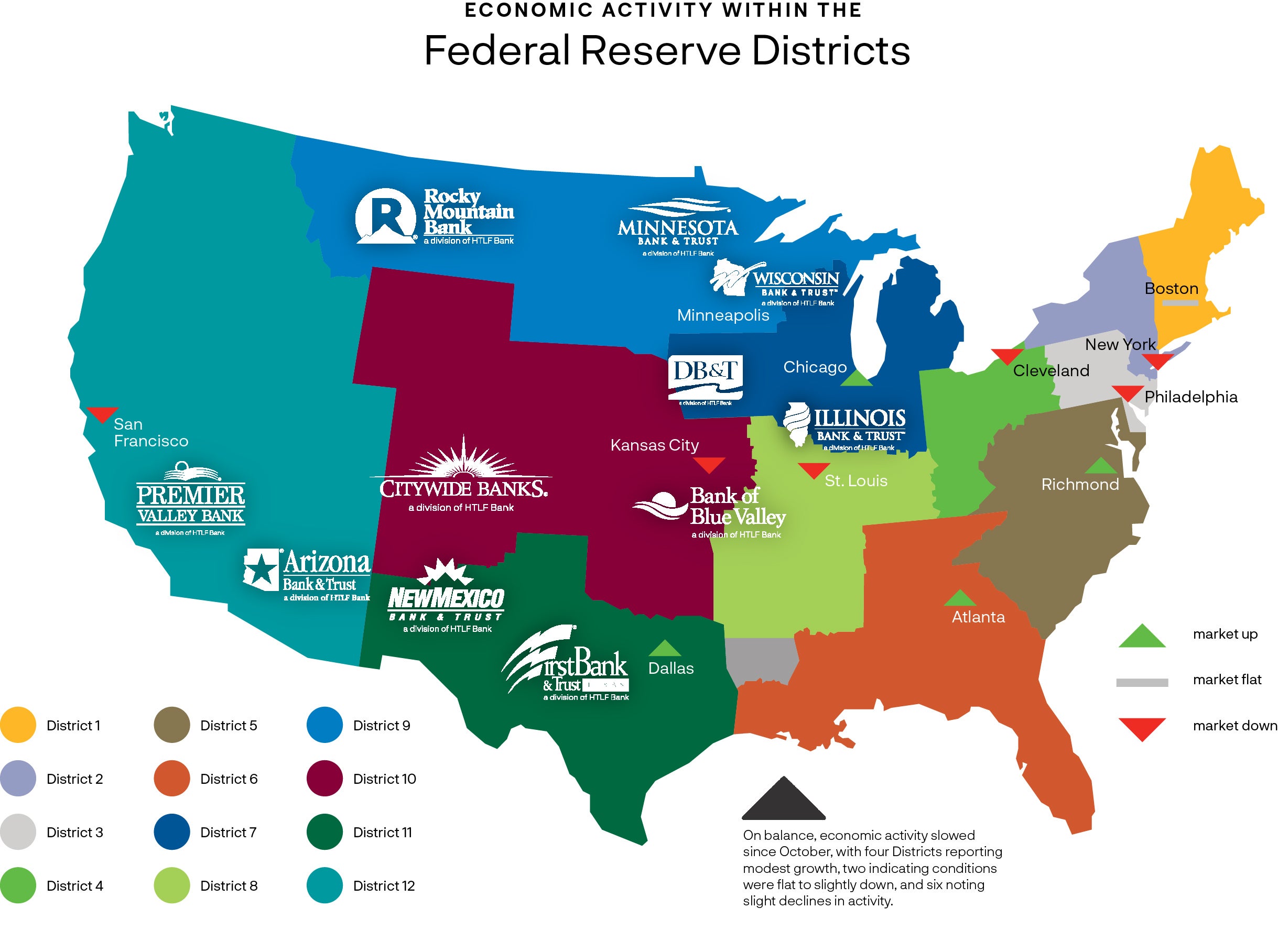

Commonly known as the Beige Book, this report is published eight times per year. Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts and other sources. The Beige Book summarizes this information by District and sector. An overall summary of the twelve district reports is prepared by a designated Federal Reserve Bank on a rotating basis.

Overall Economic Activity

Retail sales, including autos, remained mixed; sales of discretionary items and durable goods, like furniture and appliances, declined, on average, as consumers showed more price sensitivity. Travel and tourism activity was generally healthy. Demand for transportation services was sluggish. Manufacturing activity was mixed, and manufacturers’ outlooks weakened. Demand for business loans decreased slightly, particularly real estate loans. Consumer credit remained fairly healthy, but some banks noted a slight uptick in consumer delinquencies. Agriculture conditions were steady to slightly up as farmers reported higher selling prices; yields were mixed. Commercial real estate activity continued to slow; the office segment remained weak and multifamily activity softened. Several Districts noted a slight decrease in residential sales and higher inventories of available homes. The economic outlook for the next six to twelve months diminished over the reporting period.

Labor Markets

Demand for labor continued to ease, as most Districts reported flat to modest increases in overall employment. The majority of Districts reported that more applicants were available, and several noted that retention improved as well. Reductions in headcounts through layoffs or attrition were reported, and some employers felt comfortable letting go low performers. However, several Districts continued to describe labor markets as tight with skilled workers in short supply. Wage growth remained modest to moderate in most Districts, as many described easing in wage pressures and several reported declines in starting wages. Some wage pressures did persist, however, and there were some reports of continued difficulty attracting and retaining high performers and workers with specialized skills.

Prices

Price increases largely moderated across Districts, though prices remained elevated. Freight and shipping costs decreased for many, while the cost of various food products increased. Several noted that costs for construction inputs like steel and lumber had stabilized or even declined. Rising utilities and insurance costs were notable across Districts. Pricing power varied, with services providers finding it easier to pass through increases than manufacturers. Two Districts cited increased cost of debt as an impediment to business growth. Most Districts expect moderate price increases to continue into next year.

Outlook Across the 10th District

Economic activity in the Tenth District declined slightly in recent weeks. Consumers were increasingly likely to “share a roof and share meals” to manage household budget challenges. Demand for rental housing reportedly shifted away from single-bedroom units toward multi-bedroom housing where rent expenses could be shared with a roommate. Similarly, restaurateurs noted that revenues fell as more customers split dishes and eschewed expensive items. Manufacturing businesses reported little change in activity, though some contacts noted a decline in their expectations of demand over the medium term. Reports of planned capital expenditures were mixed depending on how directly businesses were supported by fiscal spending and municipal projects. Renewable energy activity in the Tenth District continued to expand at a moderate pace, driven by modest growth in wind generation and robust growth in solar installations. The outlook for renewable energy remained positive, but contacts noted skilled labor shortages and limitations on interregional electricity transmission as challenges. The agricultural economy and farm credit conditions in the District softened moderately.

Labor Markets

Labor conditions in the Tenth District remained mostly unchanged over the past month. Hiring activity in the service sector was mixed across segments. Transportation contacts reported robust employment growth while most hotel contacts reported contractions in employment. Most contacts expected to increase hiring or maintain the size their workforce over the next year, citing expected sales growth, overworked staff, and an ongoing need for workers with specific skills. Few businesses laid off workers, but many contacts reported reducing their workforce through natural attrition.

To build a skilled workforce, contacts noted raising wages for new hires, upskilling less-qualified workers, and making increased efforts to retain existing employees. Wages continued to grow at a moderate pace. Contacts highlighted raising wages as central to their retention of existing employees and attracting new hires over the past few years. However, some contacts noted an increased number of potential hires have refused the compensation packages offered, indicative of ongoing tightness in the labor market.

Prices

Prices grew at a moderate pace. While manufacturing contacts witnessed a moderation in price pressures, service firms are still facing higher prices due to tight labor market conditions. Most firms reported plans to raise prices in coming months. Contacts reported concerns about risks of higher commodity and energy prices. While higher interest rates are raising financing costs for some companies, most District firms reported a majority of their funding coming from cash financing, insulating many District firms from the higher rate environment.

Consumer Spending

Consumer spending declined slightly in recent weeks. Contacts suggested consumers were increasingly likely to “share a roof and share meals” to manage household budget challenges. Specifically, contacts in multifamily housing reported demand for single-bedroom units softened, shifting toward demand for multiple bedrooms as more renters sought to share rent expenses with roommates. Restaurant owners similarly reported that, while patronage was steady, revenues fell as more customers shared plates and avoided higher cost items. Leisure travelers accounted for a smaller share of hotel stays.

Manufacturing and Other Business Activity

Overall business activity declined slightly last month. Contacts in retail and tourism reported moderate declines in sales and revenues. Hoteliers reported occupancy levels remained steady but noted an increase in stays related to business travel. This shift in traveler type raised some concerns regarding future demand, as business travelers are reportedly more sensitive to price and business cycle fluctuations. Contacts in healthcare reported a somewhat lower outlook for use of services through the end of year. With greater enrollment in high-deductible health insurance plans in 2023, more households have yet to meet their deductible despite being late in the year and may forgo care requiring out-of-pocket payment. Manufacturing businesses reported little change in activity, though some contacts noted a decline in their expectations of demand over the medium term. Planned capital spending was mixed across segments with manufacturers reporting softening investment activity. Contacts noted the emergence of a firm-specific dichotomy whereby businesses that obtained government or defense contracts are fueling the majority of capital expenditure activity.

Real Estate and Construction

Several developers and construction managers reported raw materials costs stabilized recently. They also noted greater ability to push against escalating costs from subcontractors. Public sector funding for municipal projects sustained demand for building materials, somewhat supporting materials prices. Contacts indicated that subcontractors were becoming more available for work, with holes in their backlog schedules for the first time in several years. Though construction labor was somewhat more available, growth in labor costs remain elevated.

Energy

Renewable energy activity in the Tenth District continued to grow at a moderate pace, driven by modest growth in wind generation and robust growth in solar installations. Expectations were for a continued moderate pace of growth going into next year, driven mostly by wind generation. While growth in renewable energy in the District is expected to be slightly behind the U.S., Kansas and Missouri are slated to outpace the U.S. average in coming months. Contacts in the renewable energy sector highlighted acute skilled labor shortages and limitations on interregional electricity transmission as key challenges. While higher interest rates are adding to the renewable development costs, most of those higher costs are being passed onto consumers in the form of higher electricity rates. Contacts highlighted the significant boost to renewable development activity expected in the coming years from fiscal stimulus spending, equating that spending to “throwing gasoline on an already raging fire.”

Outlook Across the 8th District

Economic activity has slowed slightly since our previous report. Labor markets remained tight but reports of easing continued. An increased share of contacts reported holding wages flat. Prices rose moderately, though businesses continued to report consumer price sensitivity. Retailers and freight transport contacts reported slowing demand, particularly for high-end goods, but hospitality and travel contacts saw steady growth. Construction activity slowed, especially for multifamily projects, many of which have been delayed or cancelled due to higher interest rates. Loan demand fell, and delinquencies ticked up above pre-pandemic rates. The general outlook for the regional economy weakened slightly due to concerns about future demand.

Labor Markets

Employment has remained unchanged since our previous report. Labor mismatches and struggles replacing departing employees have contributed to a tight labor market but reports of easing have continued. Some contacts reported that availability of skilled workers remains a top issue, while others reported a more stable labor force for the first time in a few years. Staffing contacts reported clients are staying at jobs and less prone to leave than they were last year.

Wages have continued to grow slightly since our previous report, with an increased share of contacts reporting that wages remain level. A manufacturing contact in Evansville noted that hourly wages have risen only slightly, but an increase in overtime pay due to labor shortages has driven up labor costs. Several hiring contacts in St. Louis reported wage growth has slowed or reverted to pre-pandemic trends and fewer prospective employees have successfully negotiated for higher wages.

Prices

Prices have increased modestly since our previous report. Although approximately three-quarters of contacts reported higher labor and nonlabor input costs, many businesses are choosing to maintain or only slightly increase prices. Among respondents who do not plan to fully pass on costs to consumers, two main reasons stood out: First, some previous price increases were enough to cover more-recent cost increases. In an effort to raise prices less frequently, some businesses hedged by implementing larger increases earlier in the year. For example, an Arkansas brewer reported that they incorporated potential future volatility in input costs in past price increases. Second, increased consumer sensitivity to price increases has lessened businesses' ability to raise prices. Some items, such as luxury handbags and watches, have seen price decreases of about 15%.

Consumer Spending

District general retailers, restaurant, and hospitality contacts reported mixed business activity since our previous report. In general, auto dealers reported a decline in business activity. Louisville auto contacts reported that higher interest rates have slowed consumer demand for new car purchases. October real sales tax collections increased in Kentucky, Missouri, and Western Tennessee relative to September and decreased in Arkansas. A Little Rock pawn shop noted that, while sales over the past 18 months have been at high volumes historically, sales have slowed in recent months. A Memphis hospitality contact noted that hotel occupancy rates have been consistent compared with the same 6-month period last year.

Manufacturing

Manufacturing activity growth has declined slightly since our previous report. In Arkansas and Missouri, firms reported slight decreases in production and employment and slight increases in delivery lead times and new orders. Missouri reported a slight decrease in inventories, while Arkansas saw a very slight increase. Higher interest rates and the auto worker strikes impacted deliveries of some products for local automotive markets. On average, firms reported they expect slight decreases in production, capacity utilization, and new orders in the coming quarter.

Real Estate and Construction

Residential rental prices across the District have remained unchanged since our previous report. In the Louisville, Memphis, and Little Rock MSAs, pending sales and houses off the market in two weeks have fallen since our previous report, while inventory and months of supply for residential real estate have increased. Contacts reported high mortgage rates continuing to constrain demand for buying homes. In commercial real estate, strong demand for office space continues to be focused on Class A buildings, while vacancies remain high for Class B and C office space.

Commercial construction has slowed sharply since our previous report, particularly for new starts in the warehouse and industrial sectors. Residential construction has also seen slowing activity, with some projects sidelined or cancelled, especially for multifamily. One Memphis commercial real estate contact reported that new construction has all but stopped for developments aside from single-family housing. While the number of ongoing projects remains high, contacts with a strong existing project pipeline have reported slowing demand for future projects.

Source: FDIC State Profile

Energy

Oil field activity was flat to up over the past six weeks. The recent spate of mergers and acquisitions continued to put slight downward pressure on activity levels. Orders for oilfield services equipment were stable as customers limited spending to maintaining current capacity. In 2024, capital expenditure growth in oil and gas production is anticipated to be concentrated in international offshore drilling, with only modest increases expected in U.S. production-related work.

Agriculture

Agriculture conditions have improved slightly since our previous report. Yields for the District's primary commodity crops were at or moderately below 2022 levels. Despite this slight decline, total corn production in the District rose relative to last year. Rice production also rose, reaching levels over 33% higher than in 2022, while soybean production dipped slightly below 2021-22 levels and cotton production returned to 2021 levels. Commodity crop prices fell but remained at or above typical levels for the 2015-2020 period and stayed relatively stable throughout the reporting period. District contacts reported a mixed outlook but were generally less pessimistic than in previous reports. A Louisville contact attributed the moderate improvement in outlook to higher-than-expected yields and prices for crops such as corn and soybeans.

Nonfinancial Services

Activity in the nonfinancial services sector has cooled since our previous report. Overall, sales and sales expectations were the same or slightly lower, and the general outlook was slightly worse. A Louisville tourism contact reported postponing capital expenditures because of flagging demand but also reported local growth in the hospitality industry. A St. Louis tourism contact reported continued investment and expressed hope that the local economy would be somewhat insulated from economic challenges faced by more expensive areas. A Memphis freight contact echoed the sentiment of low demand, which, coupled with overbuying during the COVID pandemic, has contributed to slow reduction of inventory. A St. Louis transportation contact reported stable demand from ongoing customers, but less new client acquisition. A Little Rock healthcare provider reported lower sales expectations and a worsening outlook.

Get Your Financial Feed Today

The Financial Feed is the premiere publication for banking insights. Each issue prioritizes strategies on how business leaders can continue to grow despite possible economic headwinds. We hope these findings help you conquer potential challenges and capitalize on opportunities.

Source: The Federal Reserve’s Beige Book

These links are being provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by HTLF of any of the products, services or opinions of the corporation or organization or individual. HTLF bears no responsibility for the accuracy, legality or content of the external site or for that of the subsequent links. Contact the external site for answers to questions regarding its content and privacy rules.